In its Regulatory Landscape governing Financial Institutions, the Reserve Bank of India (RBI) released an Omnibus Framework for Recognising Self-Regulatory Organisations (SROs) for Regulated Entities (REs) of the Reserve Bank of India. This marks a critical milestone in the Financial Sector. The framework broadly covers the Characteristics, Objectives, Responsibilities towards Regulators and Members, Eligibility, and Governance Norms for SROs. The US has the Financial Industry Regulatory Authority (FINRA) for brokerage firms, the National Futures Association (NFA) for derivatives, and the Canadian Investment Regulatory Organization (CIRO) for overseas investment mutual funds.

The History of SROs

The idea of SROs can be traced back to the preliminary stages of market liberalization. Regulatory bodies like RBI and SEBI found it an effective mechanism to monitor the financial sector’s expanding landscape. In fact, the NSE and BSE too were initially established as SROs. The MFIN (Microfinance Industries Network) was established in October 2009 and in 2014, was recognized as the first Self-Regulating Organization for NBFC MFIs. On June 19, 2024, SROs for NBFC included NBFC Investment & Credit Companies (ICCs), Housing Finance Companies (HFCs), and NBFC Factors.

Source: BCG

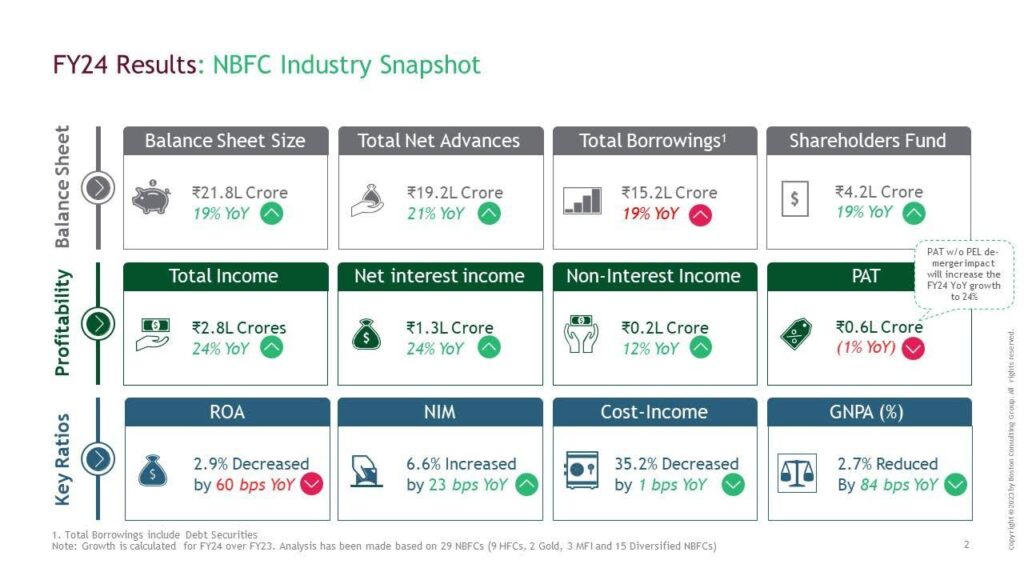

As of H12024, the total outstanding for NBFCs was INR 21.8 lakh crores (approximately USD 260 billion). With this scale of operations, the RBI felt that an SRO was a must to monitor and regulate the practices. The overall NBFC portfolio has been growing at an approximate rate of 24% from March 2022 to March 2023, prompting the RBI to advise them to form an SRO.

In the current scenario, the Reserve Bank of India (RBI) faces several challenges in regulating NBFCs, reflecting the complexities of overseeing a diverse sector that plays a crucial role in India’s financial system. These complexities include the diverse nature of the companies, their size and scale, regulatory arbitrage, rapid innovation, adequacy of risk management, data availability, and quality, the fast-paced evolution that necessitates higher levels of oversight, and the need for agility in responding to regulatory changes,

Self-regulation in NBFCs helps fill these gaps by establishing industry-specific standards and best practices that ensure responsible conduct and risk management. It helps reduce regulatory gaps, manage risks effectively, and maintain stakeholder trust. It also complements traditional regulatory frameworks by offering industry-specific insights and proactive measures to ensure financial stability and sustainable growth.

- Trust and Credibility: By voluntarily adhering to higher standards of governance and transparency, NBFCs can build trust and credibility and differentiate themselves in a competitive market.

- Prevent Regulatory Overreach: Proactive self-regulation can demonstrate to regulators that the industry can monitor itself and address issues internally, promoting a more cooperative relationship between the industry and regulators.

- Manage Systemic Risks: Self-regulation of NBFCs, particularly larger ones with significant exposure, helps identify and address systemic risks early, potentially reducing the likelihood of financial instability or contagion effects.

- Adaptability to Market Changes: Self-regulatory frameworks can be more agile and responsive to market dynamics compared to traditional regulatory processes. This allows NBFCs to adjust their practices to align with evolving business models and technological advancements.

- Industry Reputation: A well-regulated industry tends to attract more investment and talent, contributing to overall sector growth and development. Self-regulation supports a positive industry reputation, which can be crucial for long-term sustainability and competitiveness.

- Compliance with International Standards: Adherence to rigorous self-regulatory standards can demonstrate compliance with international norms, enhance cross-border credibility, and help NBFCs looking to expand globally or attract foreign investments.

Challenges of Creating SROs

Several challenges arise when creating self-regulatory organizations (SROs) and setting up regulations for the same. Some of these are listed below:

- Diverse Nature of NBFCs: NBFCs encompass a wide range of activities, including lending, investment, asset financing, infrastructure financing, and more. Each category may have different risk profiles and regulatory requirements, making it challenging to apply uniform regulations across the entire sector.

- Size and Scale: Few Large NBFCs, due to their scale of operations, have significant systemic implications if they were to face financial distress. Regulating these larger entities requires robust monitoring and intervention mechanisms to ensure financial stability.

- Risk Management: Ensuring adequate risk management practices across NBFCs, especially smaller and less sophisticated entities, is crucial. Risk concentrations, liquidity risks, and credit quality issues are among the key concerns that need continuous monitoring.

- Corporate Governance: Maintaining lofty standards of corporate governance across NBFCs can be challenging, particularly for smaller firms. Weak governance structures can lead to operational inefficiencies, risk-taking behaviors, and potential regulatory violations.

- Coordination with Other Regulators: NBFCs often operate in sectors regulated by multiple authorities (e.g., housing finance, SEBI, Ministry of Corporate Affairs). Coordinating regulatory oversight with other bodies like the National Housing Bank (NHB) or the Securities and Exchange Board of India (SEBI) requires effective communication and collaboration. SROs in India must be multi-regulator facing and have talent or consultants well versed with all the regulations.

- Data Availability and Transparency: Timely and accurate data reporting by NBFCs is essential for effective regulation. Ensuring data availability, consistency, and transparency across the sector can be challenging, especially for smaller or less tech-savvy entities. It is pertinent for the SRO to ensure a common data format and timely submission and analysis of industry data.

- Evolution of Regulatory Framework: The regulatory landscape for NBFCs is constantly evolving in response to market dynamics and emerging risks. The SRO needs to facilitate its members to adapt its regulatory framework, accordingly, striking a balance between promoting innovation and safeguarding financial stability.

- Large Players Dictating Terms: Large players normally tend to contribute more towards the corpus of the SRO, but this can lead to them dictating terms to their smaller counterparts. SROs should take care to be independent and not swayed by the dictates of large players.

In a nutshell, we can state that self-regulation in NBFCs through SROs represents a collaborative approach between industry participants and the regulatory authority to strengthen governance and mitigate risks in the financial sector. It aims to strike a balance between regulatory oversight and industry autonomy, fostering a healthier and more resilient financial ecosystem.

As we navigate the dynamic landscape of the housing finance sector in India, the proposed self-regulatory organization by RBI marks a pivotal step

towards fostering transparency, accountability, and sustainable growth. At

Altum Credo, we embrace this initiative as an opportunity to uphold the

highest standards of integrity and customer-centricity, ensuring that every

aspiring homeowner finds support and empowerment in their journey towards

affordable housing solutions.

~ Vikrant Bhagwat

MD, Altum Credo Housing Finance

While regulating NBFCs is vital for maintaining financial stability and protecting consumers, the RBI faces numerous challenges due to the sector’s diversity, rapid growth, innovation, and varying risk profiles. Addressing these challenges requires a nuanced approach, continuous monitoring, and proactive regulatory measures to ensure a resilient and well-functioning financial system. The challenge for SROs is to be impartial and raise the above concerns for the benefit of all its members.