By Shashank Silhare, Engagement Partner at Practus

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a key metric that reflects a business’s financial health and operational efficiency. A higher EBITDA margin indicates that a company is generating more profit from its operations. In this article, we’ll explore various strategies to improve your EBITDA margin and drive sustainable business growth.

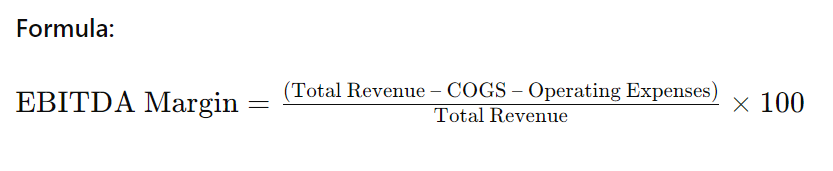

What is EBITDA Margin?

The EBITDA margin is a percentage that represents a company’s operating profit (before the effects of depreciation and amortization) relative to its total revenue. It’s a critical indicator of a business’s ability to turn revenue into profit efficiently. Simply put, a higher EBITDA margin points to better operational efficiency and profitability.

Key Strategies to Boost Your EBITDA Margin

1. Explore Ways to Increase Revenue

A company can increase its EBITDA margin by focusing on high-margin products or services, retaining and expanding its customer base through improved service, and minimizing lost orders. Strategies to achieve this include:

- Product Portfolio Rationalization: Identify and discontinue non-profitable products or services.

- Reducing Downtime: Enhance efficiency by decreasing idle time and improving cycle times.

- Performance Improvement: Focus on meeting or exceeding production plans and schedules.

2. Deploy Capital More Efficiently

Capital deployment should be optimized to ensure better returns. This can be done by:

- Monetizing Underutilized Assets: Identifying assets that are not being used efficiently and finding ways to leverage them.

- Careful Evaluation of CapEx Projects: Ensure that any new capital expenditure aligns with business objectives and provides a solid return on investment.

3. Reducing Asset Downtime and Idle Time

Proper maintenance and utilization of assets ensure uninterrupted operations, which minimizes costly downtime. Two key interventions to consider are:

- Predictive Maintenance: Use data analytics and IoT to predict and prevent equipment failures.

- Asset Utilization Monitoring: Ensure all assets are operating at their full potential to avoid inefficiencies.

4. Reduce Costs

Cost reduction is a powerful lever for improving EBITDA. Strategies to reduce costs include:

- Manpower Optimization: Streamline labor costs by right-sizing the workforce and using automation where possible.

- Lower Repairs and Maintenance Costs: Implement asset monitoring to reduce unexpected repairs.

- Energy Efficiency: Conduct energy audits and adopt energy-saving technologies to lower operational costs.

- Supply Chain Optimization: Negotiate better supplier contracts and optimize logistics to minimize supply chain expenses.

5. Improve Performance Management

Better tracking of operational performance leads to quicker responses to inefficiencies and improved decision-making. Some methods to achieve this are:

- KPI Monitoring: Regularly track key performance indicators (KPIs) like throughput, cost, and quality to identify areas for improvement.

- Employee Performance Programs: Introduce performance-based bonuses and recognition to motivate employees and improve productivity.

6. Embrace Continuous Improvement

Building a culture of continuous improvement through lean methodologies will enhance operational efficiency. This involves:

- Investing in Employee Training: Offer programs, workshops, and mentorships that help employees improve their skills and contribute to overall business success.

Practus’ Framework for EBITDA Improvement

Practus has implemented these strategies across various industries, delivering significant improvements in operational performance. By optimizing production, improving capacity utilization, enhancing quality, and reducing costs, Practus has achieved tangible results for leading companies in India and abroad.

For example, a partnership with a client led to:

- A 10-15% increase in throughput,

- A 20-30% reduction in backorders,

- A 5-15% increase in capacity utilization,

- A 10-12% reduction in production costs.

Practus achieved these results through a combination of strategic assessments, solution workshops, and implementation support, helping businesses enhance productivity and profitability.

Final Thoughts

While EBITDA margin is a vital metric for measuring operational efficiency, it should be used alongside other financial metrics such as gross profit margin, net profit margin, and return on investment (ROI) for a more comprehensive view of a company’s financial health. Ultimately, a higher EBITDA margin is desirable, but the focus should always remain on sustainable growth and long-term profitability.

By adopting the strategies outlined in this guide, companies can achieve higher EBITDA margins, increase operational efficiency, and enhance their overall business performance.

By Shashank Silhare