For most finance leaders, the discussion around AI has moved ahead of pilots and proofs of concept. After research in innovation labs, the technology is now being deployed for routine functions they manage – transaction processing, close and consolidation, performance analysis, reporting, and risk control. Teams are exploring where and which AI subfields can be confidently applied in business finance.

As machine learning, neural networks, natural language processing (NLP), Gen AI, and agentic AI systems mature, finance teams expect tangible gains in speed, accuracy, and scalability of their core processes. However, at the beginning of 2026, we still see thin adoption because finance processes carry varying levels of decision risk, regulatory exposure, and accountability. AI’s impact in finance is highly concentrated, unevenly distributed, and deeply tied to trust.

In a recent discussion on how AI is moving beyond slide decks into real-world use cases, Ravikanth Rao, Managing Partner at Practus, sat down with a panel of industry experts to hear their views on the tech stacks, ROI, and human skills that are driving this transition. The panel consisted of Dr. Saeid Motevali, Clinical Assistant Professor at Georgia University; Sree Pradhip, Founder and Chief Architect at Pulsar Ventures; and Arthur Tyson III, Founder and Fractional CFO at AT3 Agency.

Knowing Where AI Delivers Value and Where Caution is Required

The speakers reached a general consensus on how AI supports finance when aligned with three factors: process structure, data maturity, and decision risk. Processes that are repeatable, rules-driven, and underpinned by structured data lend themselves naturally to automation and augmentation. Others – especially those related to compliance, audit, and regulatory accountability – need a more cautious, human-validated approach.

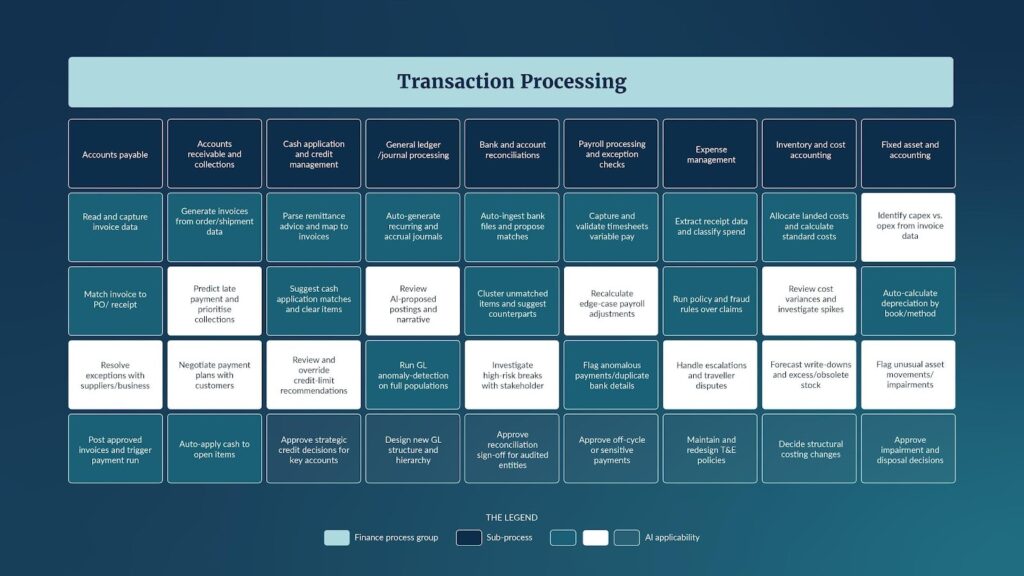

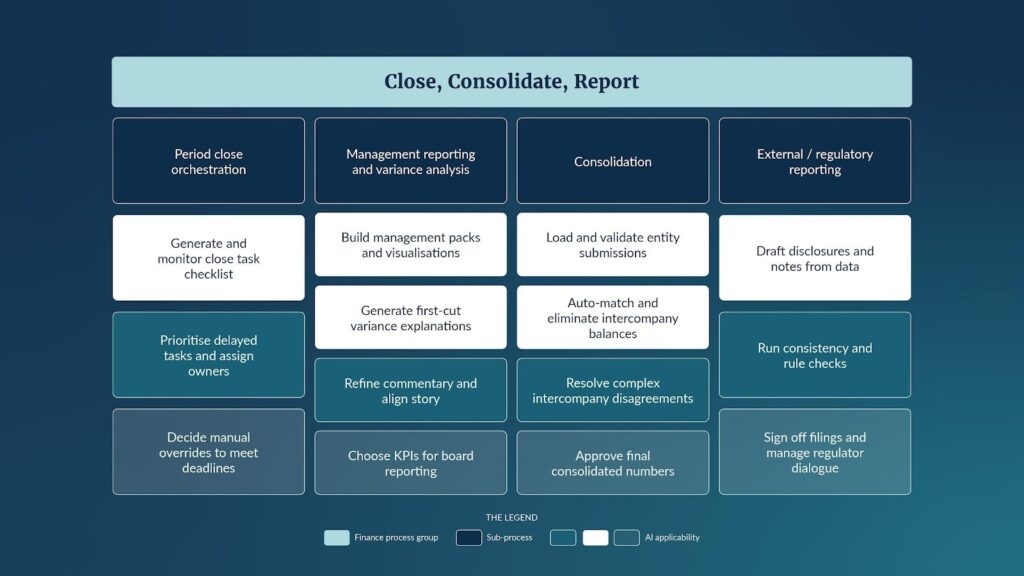

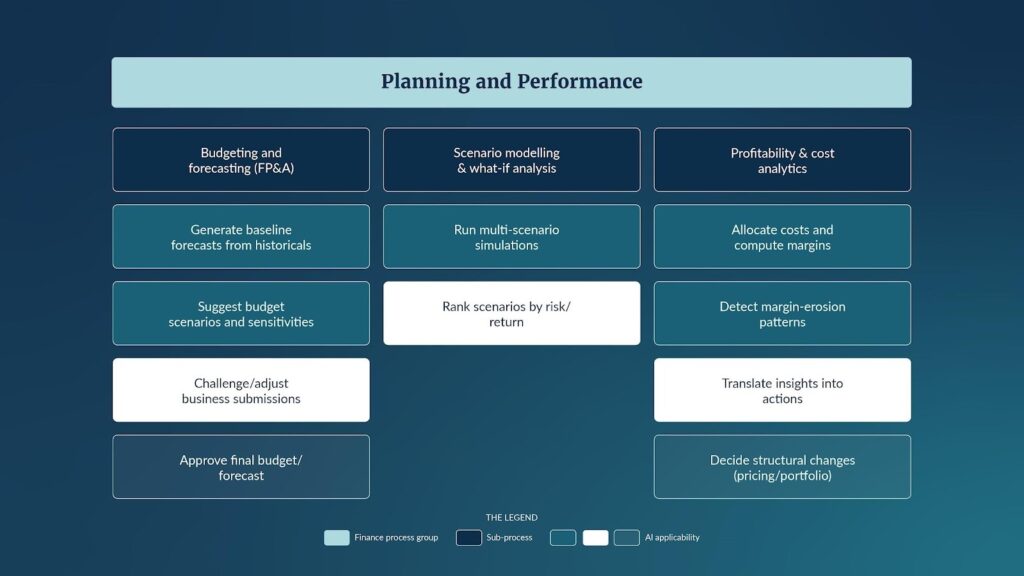

We shared tables showing the applicability of AI across key finance processes and sub-processes. In certain areas, it can be used confidently; in a few others, it passively supports decisions; and in others, human oversight is essential.

Instead of presenting AI as a ubiquitous solution, the tables demonstrates a rational operating model rooted in how finance works:

It is clear from this mapping that AI value is not the same across all domains that leverage it.

The hot zones that deliver high utility and immediate ROI are clustered around transaction-intensive and forecasting-oriented tasks. For predictive forecasting, structured historical data and well-defined outputs allow AI to rapidly generate scenarios and surface trends. Likewise, journal processing is automation-ready, giving the benefits of minimal manual effort and error rates. Procure-to-pay processes, particularly duplicate invoice detection, stand out for their ability to deliver tangible and immediate cost savings.

In contrast, there are high-friction zones where accountability transcends an organization. AI can help with auditability and regulatory oversight, but final validation cannot be delegated to it. The need for explainability, traceability, and human sign-off creates a trust gap that autonomous technology cannot bridge.

With so many use cases, AI capability will be progressively applied for finance functions. The critical factors to manage with this deployment are trust, governance, and decision ownership. Enterprises should leverage automation when their confidence is high and reinforce human-in-the-loop controls when the stakes warrant it.

How AI Has Changed Finance Leadership in the Last Three Years

A tenured finance leader from AT3 Agency, Arthur highlighted that, over the past three years, AI has also redesigned the finance function’s leadership model. “CFOs can no longer be the passive consumers of technology decisions. Ownership of finance tech stack is now a key component of their role,” he said.

The change has impacted the CFO-CIO dynamic: from traditional hand-offs to shared responsibility for outcomes. In some companies, this has evolved into a real partnership, while in others, it is exposing tensions around control, priorities, and risk ownership that must be addressed.

Mid-sized enterprises, in particular, are learning these lessons the hard way: early enthusiasm followed by stalled initiatives and cost overruns driven by weak planning for AI budget runways. Arthur felt that the root causes are not always technical. They often stem from limited knowledge of AI economics, unrealistic expectations of payback, and gaps in culture and change management.

AI-supported finance transformation is, therefore, not a pure IT initiative but a leadership and governance challenge.

Budgeting for AI: The ROI Angle

A persistent barrier to AI adoption in finance is budgeting logic. Sree Pradhip from Pulsar Ventures mentioned how traditional ROI models justify investments through direct cost savings or immediate revenue impact. But as a new element of business processes, AI has another rationale – it delivers value by improving efficiency. Its benefits are assessed in terms of time saved, fewer errors, and expanded capacity.

Faster closes, cleaner journals, and more responsive forecasting enable finance teams to devote more attention to deeper analytical work, even with unchanged headcount. Due to differences in ROI parameters, business cases that rely solely on cost takeout tend to undervalue AI’s real impact.

Strong finance leaders reframe budget discussions for AI. According to Pradhip, they quantify productivity gains, risk reduction, and decision speed to assess their ROI. These CFOs look at AI as a strategic capacity multiplier that scales the finance function without making the process more complex.

Finance Talent in the Age of AI

As AI becomes a core feature of routine finance workflows, the role of finance professionals is also undergoing a transformation. The people who were earlier appraised for their skills in data stewardship and process execution are now also evaluated for their ability to innovate, interpret, and provide decision support. Before becoming custodians of numbers, finance teams have to implement insights to deliver measurable results.

Dr. Saeid Motevali stated that this shift is playing out unevenly across the workforce. As an experienced educator at Georgia University, he observed how new entrants come with an AI-native mindset – they are intuitively comfortable working with data, digital tools, and intelligent systems. And then we still have expert mid-career professionals who often face a steep learning curve under rising pressure to reskill while also delivering business outcomes.

Dr. Motevali reassured the audience that the entire workforce does not need deep coding expertise to work with AI. What they should have is technical fluency – knowing how to work with cognitive tools, frame effective prompts, gauge output quality, and apply professional judgement. The organizations building a human-in-the-loop model augment employee capability with AI while accountability, context, and ethical responsibility remain firmly human.

Audience Q/A

The discussion prompted an active audience conversation, with panelists answering thoughtful, experience-driven questions.

Risk and security-related concerns were at the forefront. Participants wanted to know how to ensure that AI tools don’t compromise the integrity of financial data. In response, panel experts emphasized that data integrity depends on strong governance—clear data access controls, model transparency, and human validation for all high-impact outputs. AI should operate within existing risk frameworks and never bypass them.

The worries over AI replacing the CA profession in the future were manifest. The speakers agreed that AI is impacting but not replacing expert finance service profiles. Aspiring CAs, CSs, CFAs, and other accounting and auditing roles will see greater automation of routine tasks. Meanwhile, professional judgment, regulatory interpretation, and answerability will remain distinctly human.

Given the high skepticism about the technology, “Where to get started with AI?” was one of the questions posed by the audience. Panelists recommended starting with low-risk, high-impact pilots such as duplicate invoice detection or journal processing, where outcomes are measurable, and trust can be built quickly.

Another query related to technical debt: “How should companies with multiple legacy systems approach AI integration?” The answer here lies in adopting a layered approach: integrating AI incrementally rather than attempting wholesale system replacement.

When it came to tips on best practices, our panel members agreed that getting valuable outputs from AI depends on asking better questions—providing context, setting guardrails, and continuously testing results before trusting them.

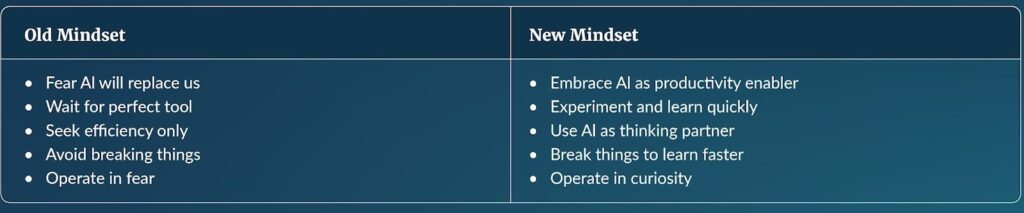

Key Takeways: The Mindset That Will Define Finance Leadership

Now that AI has already proven its capabilities in finance, the most pressing questions about its use are about the confidence with which it can be deployed. What separates leaders who move ahead with AI from those who stall is mindset.

- Leaders who win → those willing to try tools already available.

- The next generation shows the way → Leveraging AI as a thought partner, not just an automation tool.

- Tools like “AI humanizers” → drive innovation by creating safe spaces to pressure-test new ideas without fear of failure.

Top users are implementing AI for more than automation – they deploy it as a thought partner to examine assumptions, explore scenarios, and pressure-test decisions in low-risk environments. This mindset change marks a break from the past. In the next phase of finance transformation, advantage will belong to companies that know where to trust AI and strategically pair its adoption with strong governance and human judgment.