The private equity landscape in 2024 has been marked by challenges: wide bid-ask spreads, tighter liquidity, and economic uncertainties driven by higher interest rates and inflationary pressures. But as the year draws to a close, signs are emerging that 2025 may offer fertile ground for revitalized deal activity, fueled by falling rates, improving cashflows, and strategic market shifts.

Overcoming the 2024 Hurdles

Rising interest rates have created ripple effects across the private equity sector, increasing borrowing costs and suppressing valuations. Enterprise value-to-EBITDA (EV/EBITDA) multiples have fallen, and inflation has strained profit margins for businesses unable to pass on higher costs. This has caused a disconnect between buyers and sellers, with the latter reluctant to accept lower valuations for assets acquired during periods of cheap leverage and soaring multiples.

Yet, the second half of 2024 has shown a subtle shift. While deal volumes remain subdued, larger transactions are driving overall deal value. Investors are displaying a preference for established companies with resilient fundamentals, while smaller to mid-sized buyouts—facing significant valuation discounts compared to their larger peers—signal untapped opportunities for discerning investors.

The Dawn of New Avenues

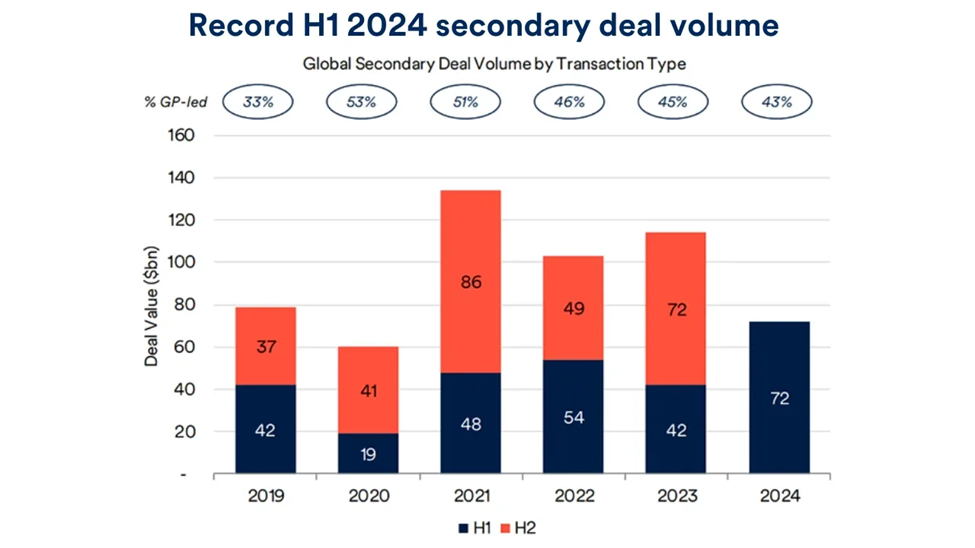

In an environment where liquidity is poised to improve, continuation fund transactions and secondary deals have risen to prominence. GP-led secondaries have hit record volumes as private equity firms extend holding periods for high-potential assets. These structures allow GPs to focus on long-term value creation while offering new investors transparency and reduced execution risk.

This shift toward innovative deal structures underscores private equity’s adaptability in navigating liquidity challenges while creating pathways for growth. LPs seeking liquidity amid tight market conditions have increasingly turned to secondary markets, adding momentum to this trend.

Why Smaller Deals Matter

A closer look at small and mid-sized buyouts reveals an intriguing dynamic. These segments continue to benefit from lower entry multiples, providing fertile ground for value creation. Historical data supports the notion that investing at lower multiples and scaling companies into higher valuation categories through full-scale business enablement initiatives delivers robust returns. The supply-demand imbalance in this space—fewer large-cap deals compared to available capital—favors smaller transactions that are poised for growth.

From 2010 to 2022, fundraising among large-cap funds grew at 10.7X the pace of deal flow, creating inflated entry multiples that suppress performance potential. By contrast, small and mid-cap funds have maintained more balanced growth, enabling investors to capitalize on underpriced assets and drive returns through business enablement, operational improvements, and strategic exits.

Resilience in the Face of Volatility

Private equity’s structural advantages have proven invaluable during turbulent times. Even amid market shocks such as inflation surges, small and mid-cap buyouts outperformed listed equities by a significant margin. For example, during the volatility of 2022, this segment delivered a positive 6% return, contrasting sharply with the negative performance of indices like the Nasdaq (-32%) and MSCI (-18%).

This resilience stems from several factors: private equity’s sector focus on less cyclical industries such as healthcare and technology, preference for recurring revenue models, and the ability to actively manage portfolio companies. Additionally, committed capital structures and performance-based incentives align interests and enable firms to avoid fire sales during downturns. These traits ensure that private equity not only weathers storms but often emerges stronger when markets stabilize.

2025: A Year of Optimism

As rates begin to decline and cost pressures ease, private equity stands at the cusp of a rebound. Large-cap funds are flush with dry powder, positioning themselves to seize opportunities as liquidity improves. Exit multiples for quality assets are likely to rise, driven by robust demand and limited supply. Meanwhile, small and mid-sized buyouts offer compelling entry points for investors seeking value and growth potential.

Continuation funds and secondary markets will continue to play a pivotal role, offering flexible solutions for liquidity-strapped LPs and enabling GPs to realize the full potential of their holdings. With these dynamics at play, private equity’s ability to adapt and thrive in evolving market conditions is set to shine in 2025.

The coming year may not only mark the return of liquidity but also a reassertion of private equity’s role as a cornerstone of long-term investment strategy, offering both resilience and opportunity in equal measure. For companies looking to drive value creation, reaching out to an experienced business enablement services partner with a knowledge of private equity and enhancing valuation would be a good idea.

By Practus Experts