The Rise of Mid-Market Private Equity in Healthcare: Evolving Strategies & Capturing Synergies

Over the last decade, private equity (PE) has made significant inroads into the healthcare sector, driven by both compelling macroeconomic tailwinds and the sector’s inherent resilience. While large-cap deals in biopharma or device manufacturing tend to grab headlines, a quieter yet more dynamic shift is underway: the rise of mid-market private equity in healthcare. This burgeoning trend is not just about deal volume: it’s about strategic evolution, operational synergy, and long-term value creation in an industry undergoing massive transformation.

Mid-market healthcare-focused PE funds have historically outperformed the broader market, benefiting from continued innovation and evolution of their investment strategies. They have also been able to maintain buyout deal activity and exits since 2020, even as the broader healthcare buyout market struggled, as exemplified by Webster Equity Partners’ successful exit from the specialty-care medical group Retina Consultants of America.

Why Healthcare – Why Now?

PE firms gravitate towards the healthcare sector for several reasons.

- Recession Resistance and Stability: Healthcare is a fundamental need. The relatively stable demand for healthcare, regardless of the state of the economy, offers a degree of stability and predictable revenue streams for PE investors seeking steady returns.

- Demographic Trends: An aging global population and rising chronic disease prevalence drive a growing demand for healthcare services. For example, in the year 2025, till July, Japanese healthcare companies have raised $154M in equity funding. In the same period last year, the sector raised $13.2M. Thus. healthcare funding in Japan has risen by 1066.25% as compared to 2024 — a staggering leap. Japan also happens to be home to the world’s largest elder population: 26.7% of the population is aged 65 or older. The consequent need for healthcare represents a major growth opportunity for PE firms.

- Consolidation Opportunities: The healthcare industry, especially in the US and emerging markets like India, is often fragmented, with many smaller practices and organizations. This fragmentation allows PE firms to come in, acquire, and consolidate these entities, creating efficient, integrated platforms.

- Technological Advancement and Innovation: Healthcare is experiencing a wave of innovation driven by technologies like AI, machine learning, digital health platforms, and medical devices. Innovators in these fields represent a further opportunity for PE firms.

- Capital and Management Expertise: PE firms can provide capital that healthcare organizations often struggle to secure through traditional financing routes. They can also help these businesses, particularly smaller practices and hospitals, streamline processes, improve efficiency, and expand their reach through their operational and strategic expertise.

- Value-Based Care Transition: Shifting from the traditional fee-for-service model to value-based care, which rewards quality and outcomes rather than volumes, incentivizes efficiency and better patient results. This encourages PE firms to invest in innovative solutions that support this model, such as analytics and population health management platforms.

Two broader trends were also seen over the last year:

- Increased investment in biopharma

- Shift towards healthcare IT, staffing, and provider services

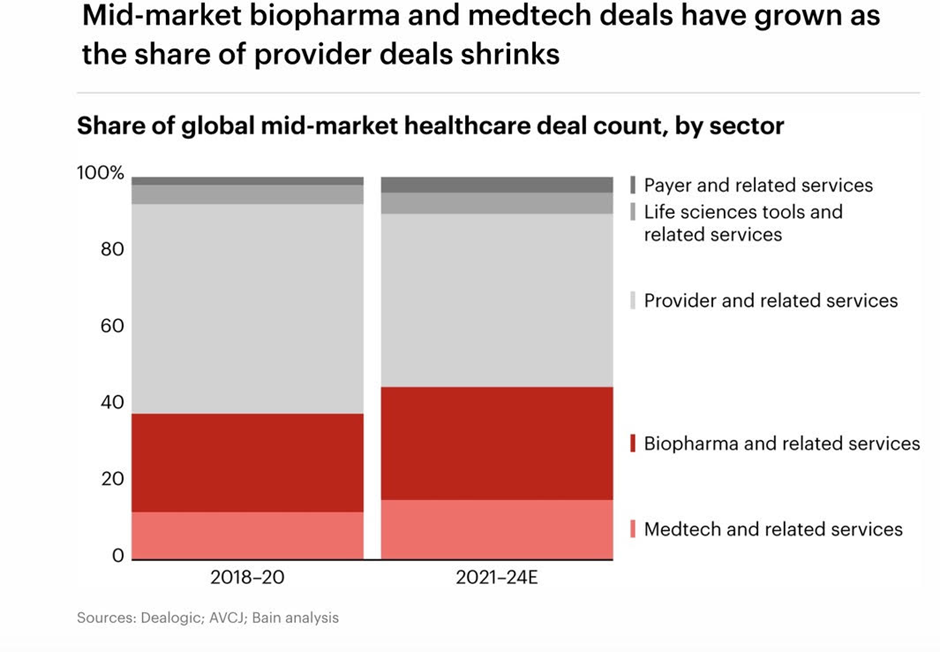

Historically, while provider deals have accounted for a majority of the deals, other adjacent sectors, such as biopharma and medtech, are also increasing traction and have seen a growing share of buyouts. These derivative deal volumes have grown by about 36% CAGR since 2022.

Mid-market private equity activity in biopharma has remained robust since 2021, contrasting with a broader decline in other healthcare PE segments. This resilience is attributed to specialized knowledge developed by many PE firms in biopharma and life sciences, enabling them to confidently pursue deals, even those with technical risks or not fitting typical buy-and-build models. These firms often target founder-owned businesses, avoiding common bid-ask spread challenges. Additionally, these PE firms are expanding their focus beyond traditional biopharma services to include companies supporting testing, inspection, certification, compliance, commercialization, and healthcare IT.

In 2024, middle-market private equity firms shifted their focus within healthcare, increasingly investing in healthcare IT, and staffing and support services for medical professionals. This trend reflects a recognition of severe shortages in auxiliary and support services, coupled with the growing complexity of revenue cycle management. These PE firms also continued strong investment in physician and other provider services, often expanding into ancillary offerings like integrating radiology into orthopedic practices or providing on-site laboratory testing.

This segment presents a sweet spot for PE: small enough for meaningful influence and value-add, but large enough for scalability and defensible market positioning.

Evolving Strategies for the Mid-Market

1. Platform-and-Add-On Models (Buy-and-Build)

One of the most successful strategies in mid-market healthcare PE has been the “platform and add-on” approach. A strong regional player acts as a pivot around who the entire platform of adjacent services are built to expand geographic presence, diversify revenue, and create economies of scale to consolidate smaller practices or services.

For example, if a PE fund that acquires a network of urgent care clinics in the US, it will bolt on additional clinics and standardize operations between the clinics and centralize billing under a common brand over 3-5 years. As a result, there is a cost optimization due to operational efficiencies, leading to higher EBITDA.

2. Value-Based Care Alignment

As the US healthcare system shifts toward value-based care (VBC), mid-market PE firms are integrating these models into their portfolio companies. This involves:

- Partnering with payers for shared savings contracts

- Investing in care coordination and data analytics

- Building population health capabilities

Being VBC-ready gives mid-market platforms a competitive edge and better exit opportunities, as strategic buyers increasingly seek partners aligned with future care models.

3. Technology Enablement

As a cornerstone for consolidation, PE-backed deals are now pushing for tech consolidation, leading to a digital transformation of the combined entity. This consists of deploying technology to streamline everything from scheduling and electronic health records (EHRs) to remote monitoring and AI-powered diagnostics. Mid-market firms are often more agile in integrating technology, resulting in better patient experience, lower costs, and stronger margins.

Challenges and Risk Mitigation

Despite the appeal, mid-market PE investing in healthcare is not without its challenges:

- Regulatory Complexity: With each state in the US having its own set of regulations, regulatory compliance will become a key factor in the operations.

- Workforce Pressures: Any consolidation will lead to identifying cost duplication and optimization. This results in staff cuts.

- Reimbursement Uncertainty: Shifting CMS policies and payer rules can affect margins quickly.

- Integration Risk: Roll-up strategies risk culture clash, patient dissatisfaction, or provider turnover if poorly managed.

Leading firms are mitigating these risks by involving clinicians early, leveraging healthcare-specialist operating partners, and performing robust regulatory due diligence.

Future Outlook

The mid-market healthcare PE space is poised for further growth and specialization, as investors are now turning their attention towards high-demand, underpenetrated niches such as pediatric behavioral health, women’s health and fertility, addiction recovery services, and telehealth-enabled chronic care management.

The convergence of AI, remote care, and data interoperability is opening new vistas in efficiency and patient engagement, making mid-market platforms ideally positioned for digital-first healthcare.

As healthcare continues to evolve, so too do the strategies that private equity firms deploy to build value. Mid-market PE, with its operational agility, long-term investment horizon, and deep sector expertise, is well-positioned to reshape the healthcare landscape.

By combining strategic capital with operational acumen, mid-market PE firms are not only generating attractive returns for their investors but also playing a vital role in improving access, quality, and efficiency within the healthcare ecosystem. Their evolving strategies, particularly in platform building, specialty focus, and technology integration, coupled with a relentless pursuit of synergies, position them as key drivers of innovation and consolidation. As health care becomes more democratized, the mid-market PE playbook will undoubtedly remain at the forefront of the industry’s evolution.

By Abhinav Kumar