The Business transformation Solutions provided by Practus assisted the electrical goods manufacturer to improve net realization (pricing) on products by 2% through SKU rationalization & pricing decisions based on data.

| Client Name | Industry | Ownership | Management | No. of Employees | ROI On Fee | Size |

| A Manufacturer Of Electrical Goods | Industrials | Public Limited Company | Professional | ~1000 | 25x | $709 million |

About The Company

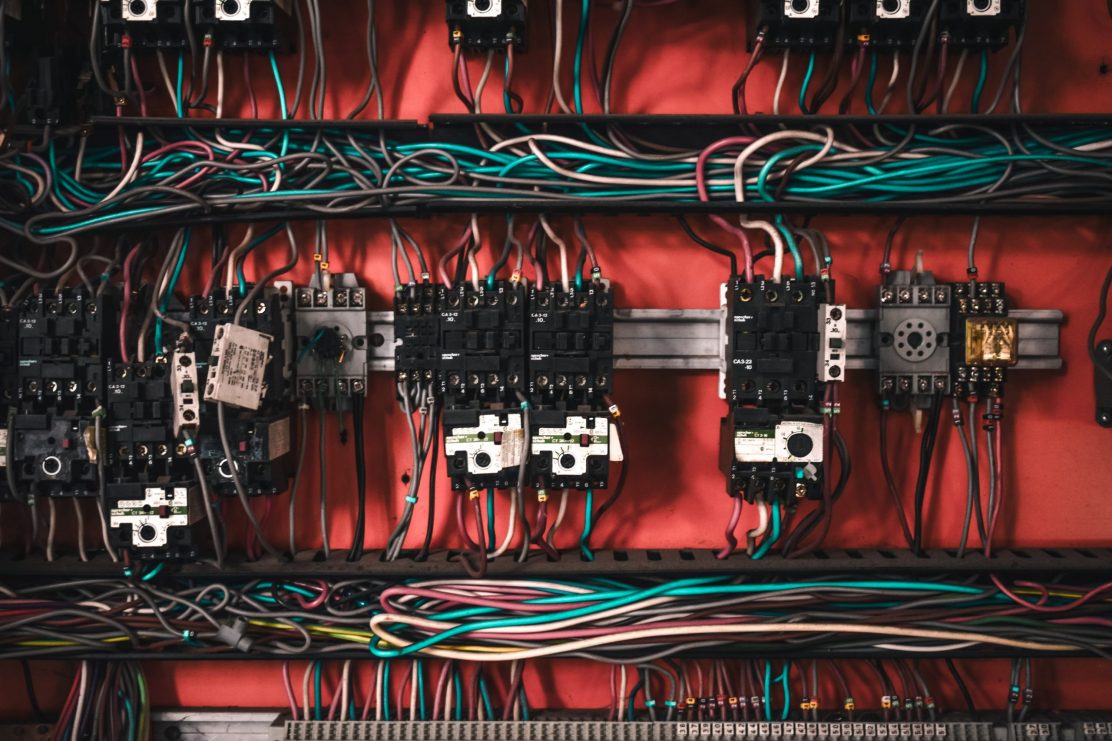

Wire Central is a leading company in the Electrical Industry. It has the reputation of being the fastest-growing company in the Indian Cables sector. Wire Central is engaged in the business of manufacturing and selling wires and cables and fast-moving electrical goods ‘FMEG’. Apart from wires and cables, they manufacture and sell FMEG products such as electric fans, LED lighting and luminaires, switches and switchgear, solar products, conduits and accessories.

Practus’ Role in Business Transformation

- Revenue Optimization includes SKU rationalization, data-driven pricing, and the creation of a costing model.

- Improving Manufacturing Efficiency: Optimizing production runs, lowering production costs, and making greater use of manufacturing facilities.

- Working Capital Management and Treasury: Inventory levels are reduced through centralized procurement and storage, dealer financing schemes are implemented to reduce DSO, and banking relationships are consolidated to obtain better terms.

- Decision Support systems and Analytics: Pricing matrix for commodity, Forex price movements and Hedging, Business and Operations analytics, Management Commentary and Data visualization.

Impact Delivered in Business Transformation

- As a result of SKU rationalization and data-driven pricing decisions, net realization (price) on items increased by 2%.

- Manufacturing overheads were cut by 1% by consolidating manufacturing locations and optimizing production runs.

- EBIDTA increased by 5% as a result of centralized procurement, greater net realization, and overhead reduction.

- Reduction of finance expenses by 25% due to consolidation of banking partnerships and better conditions negotiated.

- Increase in working capital by reducing DSO and DIO by 30 and 15 days, respectively.